investment net present value zero

shopping hours union square aberdeen

Net Present Value Rule Definition & Example | InvestingAnswers

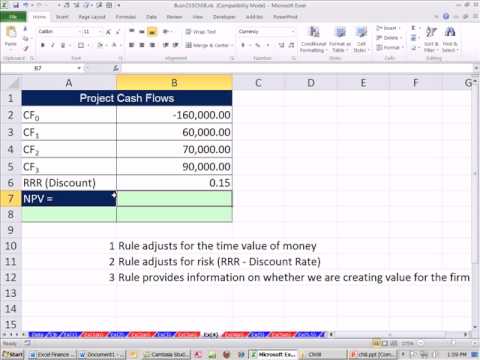

We explain the definition of Net Present Value Rule, provide a clear example of how it . and explain why it's an important concept in business, finance & investing. . If NPV = 0, the project/acquisition will neither increase nor decrease value of .

http://www.investinganswers.com/financial-dictionary/investing/net-present-value-rule-2944

http://www.peta.org/b/thepetafiles/archive/tags/Natalia+Villaveces/default.aspx

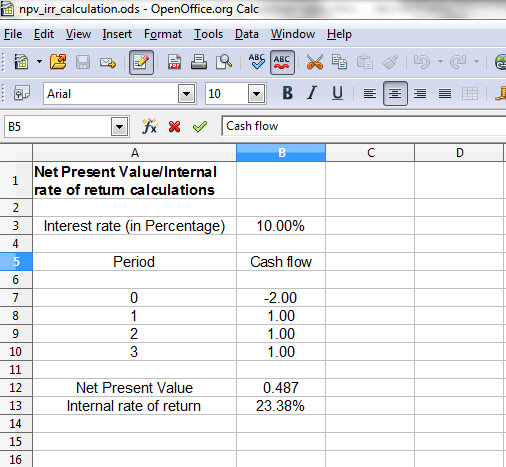

NPV and IRR -- Measures for Evaluating Investments

Dec 5, 2009 . The right orange dot shows where the second investment's curve crosses the NPV=0 line. This is well to the right of the first investment's .

http://hspm.sph.sc.edu/courses/econ/invest/invest.html

http://jurbank.com/sari-latest-sex-3gp/

Instructions

-

-

1

shop your way rewards promo code

NPV and IRR -- Measures for Evaluating Investments - Sam Baker

This discount rate, 0.0547 or 5.47%, is the internal rate of return for this investment -- it is the discount rate that makes the net present value equal 0. You can try .

http://www.sambaker.com/econ/invest/invest.html

http://torrentz.eu/la/latin+lover+natalia+villaveces+playboy-qInvestment analysis

If the NPV is zero then you should be indifferent to the investment unless it has non-financial considerations that are not represented by the cashflow. If the NPV .

http://www.i-programmer.info/ebooks/financial-functions/430-investment-analysis.html

http://www.youtube.com/watch?v=G1ToCkqLKnU -

2

Chapter 7: Net Present Value and Other Investment Criteria - Faculty

NPV = PV of future cash flows – Investment. NPV Decision Rule: If NPV ? 0 then accept. For Mutually exclusive investments, Select the project with the largest .

http://faculty.kfupm.edu.sa/FINEC/mfaraj/fin301/notes/Ch7.pdf

http://cine-latino.blogspot.com/2009/03/desnuds-natalia-villaveces.html -

-

3

Economics: Present Value and Investment Decisions

Income earned in the future is often evaluated in terms of its present value . . It will use the interest rate to calculate the present value of the future net income that it expects . 0. ?$7,000. —. ?$7,000. 1. 2,000. $2,0000/(1.10)1. 1,818. 2. 2,000 .

http://www.cliffsnotes.com/study_guide/Present-Value-and-Investment-Decisions.topicArticleId-9789,articleId-9788.html

http://rapidlibrary.com/index.php?q=natalia+villaveces+latin+lover -

4

What is net present value (NPV)? definition and meaning

The amount of investment ($1,000 in this example) is deducted from this figure to arrive at net present value which here is zero ($1,000-$1,000). A zero net .

http://www.businessdictionary.com/definition/net-present-value-NPV.html

http://adtdok.jugem.jp/?eid=4 -

5

Net present value - Wikipedia, the free encyclopedia

NPV > 0, the investment would add value to the firm, the project may be accepted . Since the NPV is greater than zero, it would be better to invest in the project .

http://en.wikipedia.org/wiki/Net_present_value

http://minnesota.publicradio.org/collections/special/columns/music_blog/archive/2006/10/separated_at_bi_6.shtml -

6

apartments ratings grand rapids

Net Present Value Calculator

arrow Home Calculators Investment Calculators Net Present Value Calculator . Discount Rate (% / Year). Cash Flow In ($), Cash Flow Out ($). Year 0. Year 1 .

http://www.money-zine.com/Calculators/Investment-Calculators/Net-Present-Value-Calculator/

http://en.wikipedia.org/wiki/Natalia_VillavecesInvestment Net Present Value - R. Preston McAfee

Undertake project if NPV > 0. • Preferable to calculating internal rates of return ( solve equation NPV=0 for r) because IRR not well defined. Investment Under .

http://www.mcafee.cc/Classes/Ec11/PDF/Investment.pdf

http://www.imdb.com/name/nm1356861/publicity

-

1

Tips & Warnings

TV MANUFACTURE CODES

0000

0001

DVD PLAYER MANUFACTURE CODES

Aiwa -- 2073

Audiovox -- 2074

Bose- 2062; 2071

JVC -- 2007; 2010; 2011; 2012; 2013

Phillips-2002; 2009; 2021; 2022; 2023; 2043

RCA -- 2005; 2024; 2038; 2110

Sony -- 2015; 2018; 2034; 2039

Zenith -- 2069; 2094

DVD RECORDER MANUFACTURE CODES

Panasonic - 2103

Philips -- 2107

Sony -- 2108

DVR MANUFACTURE CODES

Philips -- 1042

RCA -- 1116

TiVo -- 1116

VCR MANUFACTURE CODES

Emerson -- 1044; 1049; 1051; 1052; 1053; 1055; 1061; 1069; 1087; 1090; 1106

JLC - 1053

investment net present value zero an Olevia RCL TU Remote to a Dish Network Box

investment net present value zero an Olevia RCL TU Remote to a Dish Network Box

investment net present value zero a Comcast Remote for an Olevia TV

investment net present value zero a Comcast Remote for an Olevia TV

investment net present value zero an Olevia TV to Digital Cox

investment net present value zero an Olevia TV to Digital Cox

investment net present value zero an Olevia RCL TU Remote to a Dish Network Box

investment net present value zero an Olevia RCL TU Remote to a Dish Network Box

investment net present value zero a Comcast Remote for an Olevia TV

investment net present value zero a Comcast Remote for an Olevia TV

10 Apps You Need To Take On Vacation

10 Apps You Need To Take On Vacation

Tips for Taking Great Fireworks Photos

Tips for Taking Great Fireworks Photos

Facebook Fundamentals

Facebook Fundamentals

Why You Should Shoot in Camera Raw

Why You Should Shoot in Camera Raw